The Ultimate Guide to Avoiding Medicare Penalties: A Step-by-Step Guide for Working Seniors

Are you turning 65, still working hard, and excited about Medicare?

But then you hear horror stories about -late enrollment penalties, -IRMAA surcharges, and -confusing rules.

This guide is designed to cut through the noise and give you a clear, step-by-step plan to protect your retirement savings.

After reading this guide, you'll know how to

Avoid costly Medicare penalties

Maximize your coverage while still working

Make informed decisions about your healthcare.

Turning 65 is a significant milestone, a gateway to new experiences and well-deserved relaxation. But along with the excitement comes a flood of information about Medicare, often accompanied by anxiety about potential penalties and confusing rules. Imagine this: You're still working hard, enjoying your job, and relying on your employer's health plan. But then you start hearing stories about late enrollment penalties, IRMAA surcharges, and the dreaded "creditable coverage" requirement.

This guide is designed to cut through the noise and give you a clear, step-by-step plan to protect your retirement savings. We understand that navigating Medicare while still working can feel overwhelming, and our goal is to empower you with the knowledge and tools you need to make informed decisions.

By reading this guide, you'll learn how to:

Avoid costly Medicare penalties, saving you potentially thousands of dollars over your lifetime.

Maximize your coverage while still working, ensuring you have the right protection for your healthcare needs.

Make informed decisions about your healthcare future, giving you peace of mind and control over your finances.

Understand the complex rules and regulations surrounding Medicare, eliminating confusion and stress.

Identify the potential pitfalls and traps that many working seniors face when it comes to Medicare.

Ready to take control of your Medicare journey? Let's dive in!

Unveiling the Mystery: Understanding Medicare Late Enrollment Penalties

One of the biggest fears surrounding Medicare is the dreaded late enrollment penalty. But fear not! Understanding these penalties is the first step to avoiding them. Let's break down each penalty in detail:

Part A Late Enrollment Penalty:

What is it? Part A (hospital insurance) helps cover inpatient hospital care, skilled nursing facility care, hospice care, and some home health care. Most people don't pay a monthly premium for Part A because they have enough work history (40 or more quarters, roughly 10 years of work) to qualify for premium-free Part A.

Who is exempt? You are exempt from the Part A late enrollment penalty if you or your spouse have 40 or more quarters of work history where you paid Medicare taxes.

How is it calculated? If you don't qualify for premium-free Part A and you delay enrolling when you're first eligible, your monthly Part A premium may increase by 10%. This penalty applies for twice the number of years you delayed enrollment.

Example: Let's say you don't have enough work history to qualify for premium-free Part A, and you delay enrolling for 3 years after you turn 65. Your Part A premium will increase by 10% for 6 years (twice the number of years you delayed). So, if the current standard Part A premium is $505 per month, your penalty would be an additional $50.50 per month for six years, costing you over $3600.

How to enroll retroactively: If you initially delayed enrolling in Part A but now believe you qualify for premium-free Part A based on your work history or your spouse's work history, contact the Social Security Administration to confirm your eligibility and enroll retroactively.

Why this matters: Avoiding this penalty can save you hundreds, if not thousands, of dollars over the years.

Part B Late Enrollment Penalty:

What is it? Part B (medical insurance) helps cover doctors' services, outpatient care, and preventive services. Most people pay a monthly premium for Part B.

Who is exempt? You are exempt from the Part B late enrollment penalty if you are covered by a group health plan based on current employment (either your own or your spouse's). This is known as a Special Enrollment Period. You also do not need to enroll if you have certain jobs like working for the federal government or in the military.

How is it calculated? If you don't enroll in Part B when you're first eligible and you don't have coverage from a group health plan based on current employment, your monthly Part B premium may increase by 10% for each full 12-month period that you could have had Part B but didn't. This penalty lasts for as long as you have Part B.

Example: Let's say you delay enrolling in Part B for 18 months because you thought you didn't need it. The penalty is calculated based on one full 12-month period, resulting in a 10% increase. If the current standard Part B premium is $185.00 per month, your penalty would be an additional $18.50 per month for as long as you have Part B. Over time, this penalty can add up to tens of thousands of dollars.

Why this matters: The Part B penalty is lifelong, and it increases with each subsequent premium increase. Avoiding this penalty is crucial for protecting your long-term financial stability.

Part D Late Enrollment Penalty:

What is it? Part D (prescription drug insurance) helps cover the cost of prescription drugs.

Who is exempt? You are exempt from the Part D late enrollment penalty if you have "creditable prescription drug coverage" from another source (e.g., your employer plan, TRICARE, or VA benefits). "Creditable coverage" means that the plan covers at least as much as the standard Medicare prescription drug benefit.

How is it calculated? If you don't enroll in Part D when you're first eligible and you don't have creditable prescription drug coverage, your monthly Part D premium may increase by at least 1% of the "national base beneficiary premium" for each full month that you didn't have creditable coverage. The national base beneficiary premium changes each year, and the penalty is calculated based on the most recent national base beneficiary premium.

Example: Let's say you delay enrolling in Part D for 12 months without creditable coverage. The national base beneficiary premium for 2025 is $36.78. Your penalty would be at least 12% of $36.78, or $3.68 per month. This penalty is added to your monthly Part D premium and lasts for as long as you have Part D.

Oprah Isn’t Handing Out IRMAA Surprises: How to Navigate Surcharges

IRMAA (Income-Related Monthly Adjustment Amount) sounds like something Oprah would include in her list of favorite things, right? But alas, it's not a freebie.

IRMAA is a surcharge that adds to your Part B and Part D premiums if your income is above a certain level. Here's what you need to know:

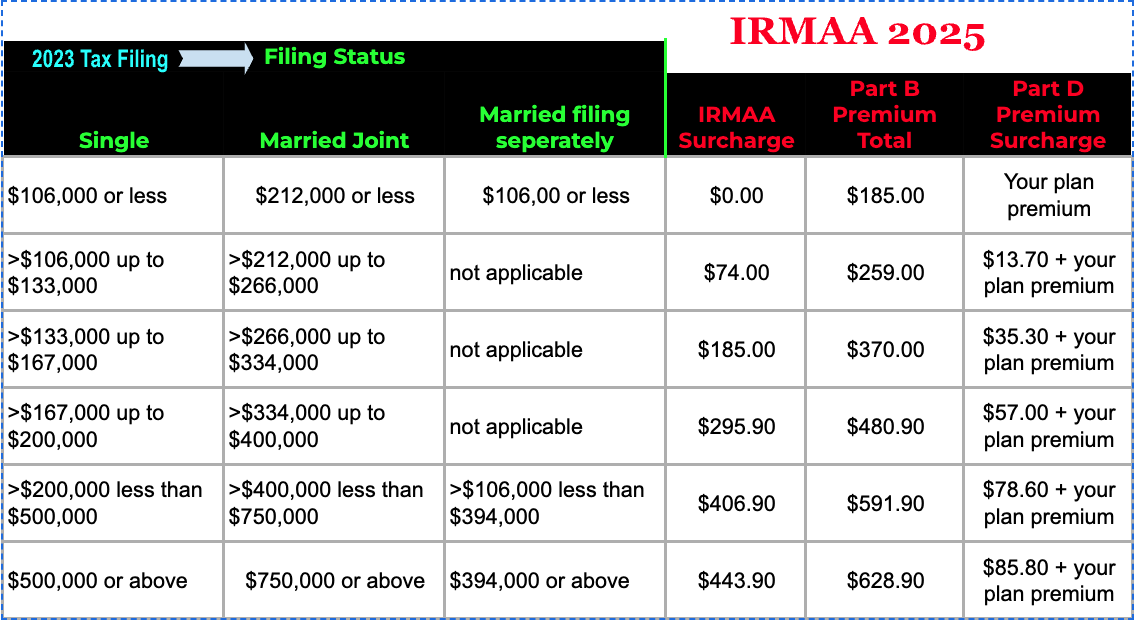

How IRMAA Works: The Social Security Administration looks at your modified adjusted gross income (MAGI) from two years ago (for 2025, they'll look at your 2023 tax return) to determine if you'll pay an IRMAA surcharge. MAGI includes your adjusted gross income, plus tax-exempt interest income. Social Security will send you a letter if you are subject to IRMAA, outlining how they calculated your MAGI.

2025 IRMAA Income Thresholds:

(Remember to always double-check the Medicare.gov website for the most up-to-date IRMAA thresholds: https://www.medicare.gov/basics/costs/medicare-costs).

Appealing an IRMAA Determination: If you've had a life-changing event (e.g., retirement, death of a spouse, divorce, loss of income due to job loss) that has significantly reduced your income, you can appeal the IRMAA determination. You must file Form SSA-44 with the Social Security Administration and provide documentation of the event.

This appeal allows you to request a reassessment of your income based on your current financial situation, potentially reducing or eliminating the IRMAA surcharge.

If you have retired and your current income does not meet the threshold, this reassessment can be particularly beneficial. To initiate this process, you will need to provide documentation that verifies your change in employment status and income, such as a letter from your employer or recent tax returns.

Strategies to Reduce MAGI: While we are unable to assist with Financial advice, they would need to find a qualified person to assist with these matters and we cannot give financial advice, it's important to consider:

Contributing to a traditional IRA or 401(k): These contributions are tax-deductible and can reduce your AGI.

Investing in tax-exempt municipal bonds: Interest from municipal bonds is generally tax-exempt.

Carefully planning withdrawals from retirement accounts: Consider the tax implications of different withdrawal strategies.

Donating to charity: Charitable contributions can be tax-deductible.

Is Your Employer Coverage Friend or Foe? Determining Creditable Coverage

Knowing whether your employer's health plan offers "creditable coverage" is crucial for avoiding Part D late enrollment penalties. But what exactly is creditable coverage? Think of it as a seal of approval, signifying that your employer's prescription drug benefits are at least as good as what Medicare Part D offers.

What Makes a Plan "Creditable?" To be considered creditable, a prescription drug plan must meet certain requirements set by Medicare:

Coverage for Both Generic and Brand-Name Drugs: The plan must cover a wide range of prescription drugs, including both generic and brand-name options.

Actuarial Equivalence: The plan's overall benefits must be actuarially equivalent to the standard Medicare Part D coverage. This means that, on average, the plan must pay out at least as much in prescription drug costs as Medicare Part D would.

Reasonable Access: The plan must provide reasonable access to covered prescription drugs.

How to Find Out If Your Plan is Creditable: Your employer or union is required to notify you each year whether your prescription drug coverage is creditable. This notice is usually sent in the fall. However, it is your responsibility to determine if your plan is creditable or not, even if you haven't received the notice

Sample Email to Request Creditable Coverage Information: If you haven't received the notice or you're unsure whether your plan is creditable, send the following email to your HR department:

Subject: Request for Creditable Coverage Information for Medicare Part D

Dear [HR Contact Name],

I am turning 65 and becoming eligible for Medicare. I would like to request a copy of the "Notice of Creditable Coverage" for our company's prescription drug plan. This notice will help me determine whether I need to enroll in Medicare Part D to avoid late enrollment penalties.

Thank you for your assistance.

Sincerely,

[Your Name]

What Types of Coverage are NOT usually Creditable?

While there are always exceptions, these types of plans typically don't meet the requirements for creditable coverage:

COBRA

Discount Drug Cards

Some Retiree Plans

Even if Your Plan is Creditable, Read the Fine Print!

Even if your employer's plan is deemed "creditable," it's essential to review the plan's formulary (list of covered drugs) carefully. Some specific drug tiers or medications may not be covered at the same level as Medicare Part D.

Mastering the Art: Strategies to Maximize Coverage and Minimize Costs

Medicare can feel like a puzzle, but with the right strategies, you can assemble a plan that maximizes your coverage while keeping costs in check.

Here are some key strategies to consider:

Explore Medicare Savings Programs (MSPs):

If you have limited income and resources, you may qualify for a Medicare Savings Program. These programs help pay for Medicare costs, such as premiums, deductibles, and coinsurance. The four main MSPs are:

Qualified Medicare Beneficiary (QMB): Helps pay for Part A and Part B premiums, deductibles, and coinsurance.

Specified Low-Income Medicare Beneficiary (SLMB): Helps pay for Part B premiums only.

Qualifying Individual (QI): Helps pay for Part B premiums only.

Qualified Disabled and Working Individuals (QDWI): Helps pay for Part A premiums only.

Note: Income and resource limits vary by state and are subject to change each year. Contact your local Area Agency on Aging or your state Medicaid agency for the most up-to-date information.

Shop Around for Medicare Advantage Plans and Medigap Policies:

Once you're enrolled in Medicare, you'll need to choose between enrolling in a Medicare Advantage plan or purchasing a Medigap policy. Here's a quick overview of the key differences:

Medicare Advantage Plans: These are private insurance plans that contract with Medicare to provide your Part A and Part B benefits. They often include extra benefits, such as vision, dental, and hearing coverage. Medicare Advantage plans typically have lower monthly premiums than Medigap policies, but they may have higher cost-sharing (copays, coinsurance, deductibles).

Medigap Policies: These are standardized private insurance plans that help supplement your Original Medicare benefits. They help pay for out-of-pocket costs, such as deductibles, coinsurance, and copays. Medigap policies typically have higher monthly premiums than Medicare Advantage plans, but they offer more predictable costs and greater freedom to choose your doctors.

Consider Extra Benefits: When choosing a Medicare Advantage plan or Medigap policy, consider your individual healthcare needs and priorities. Do you need vision, dental, or hearing coverage? Are you concerned about high out-of-pocket costs? Do you want the freedom to see any doctor you choose?

Maximize Preventative Care: Take full advantage of the preventative services covered by Medicare, such as annual wellness visits, screenings, and vaccinations. These services can help you stay healthy and prevent costly medical problems down the road.

Review Your Coverage Annually: Your healthcare needs may change over time, so it's important to review your Medicare coverage each year during the Annual Enrollment Period (October 15 - December 7). This is the time to switch Medicare Advantage plans or Part D plans.

FAQ: Demystifying Common Questions

Medicare can feel like a maze, and it's natural to have questions. Here are answers to some of the most frequently asked questions about Medicare and working:

Q: I'm turning 65, but my spouse is younger and covered under my employer plan. What should I do?

A: You should enroll in Medicare Part A when you turn 65, as it's usually free. You can delay enrolling in Part B as long as you have creditable coverage from your employer plan. Shop around for health insurance plans to cover your spouse and any other dependents who are not eligible for Medicare.

Q: My employer is switching our retiree health plan to a Medicare Advantage plan. Do I have to enroll?

A: It depends on the terms of your retiree plan. Some employers require you to enroll in the Medicare Advantage plan to maintain coverage. Review the plan documents carefully or contact your benefits administrator

Q: Can I delay enrolling in Part B if I have VA benefits?

A: Yes, you can delay enrolling in Part B without penalty if you have VA benefits. However, it's important to understand what your VA benefits cover and whether you need additional coverage for services not covered by the VA.

Q: What happens if I lose my employer coverage after I turn 65?

A: You'll have a Special Enrollment Period to enroll in Medicare Part B. Contact Social Security or Medicare to enroll as soon as possible to avoid any gaps in coverage.

Q: Are there any resources for help navigating Medicare options and the application process?

A: I'm an independent health insurance broker, which means I can shop most health insurer's to educate you and help you enroll in the Medicare option of your choosing. Also, State Health Insurance Assistance Programs (SHIPs) offer free, unbiased counseling and assistance to Medicare beneficiaries. Find your local SHIP here: link to SHIP directory.

Q: I'm confused about the difference between Medicare Advantage and Medigap. Can you explain it simply?

A: Medicare Advantage plans are like HMOs or PPOs – they're managed care plans that offer all your Medicare benefits in one plan, often with extra benefits like vision, dental, and hearing. Medigap policies, on the other hand, are designed to supplement your Original Medicare benefits and help pay for out-of-pocket costs. Advantage plans have networks whereas Medigap plans allow you to go anywhere in the US for care.

Q: How does the government look into my income, what if I disagree with what they said is coming in for my income amount?

Medicare uses income information from the Social Security Administration (SSA) and the Internal Revenue Service (IRS) to determine IRMAA surcharges. If you disagree with the SSA and IRS, you may need to file an appeal with them to correct information, then contact Medicare to update your status.

Connecting the Dots: Visualizing Your Medicare Path

Navigating Medicare can feel like charting a course through uncharted waters. But with a clear roadmap, you can avoid costly missteps and ensure a smooth journey. Here's a timeline of key enrollment periods and deadlines:

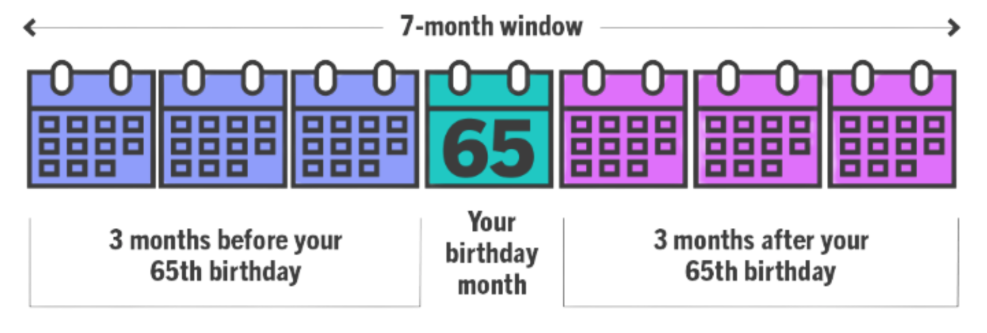

Initial Enrollment Period (IEP)

This is the 7-month period surrounding your 65th birthday (3 months before, the month of your birthday, and 3 months after). This is your first chance to enroll in Medicare.

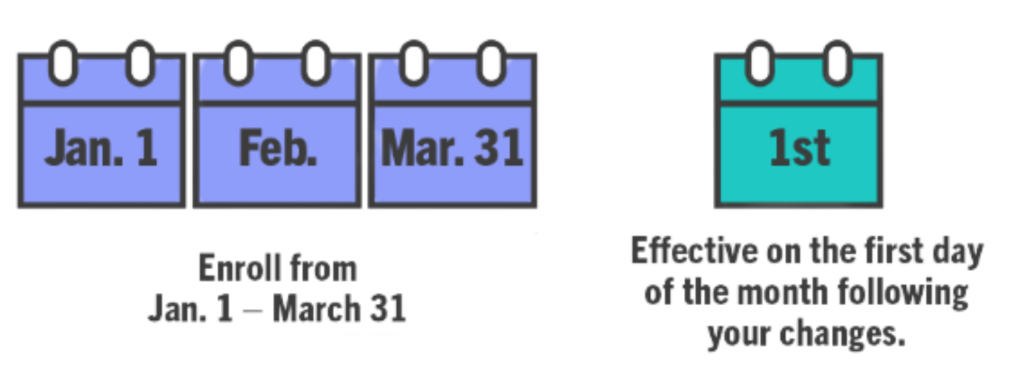

General Enrollment Period (GEP)

This runs from January 1 to March 31 each year. If you missed your IEP, you can enroll in Medicare during the GEP, but you may be subject to late enrollment penalties.

Special Enrollment Periods (SEP)

These are triggered by certain events, such as loss of employer coverage, a change in residence, or a change in your plan's service area. SEPs allow you to enroll in Medicare outside of the IEP or GEP.

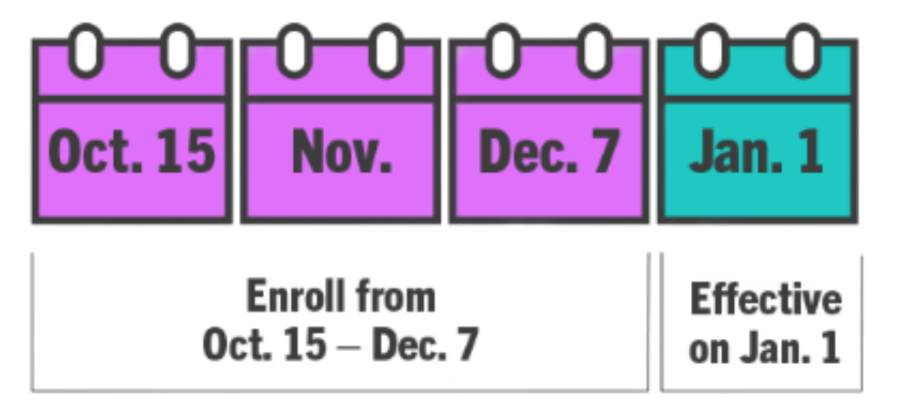

Annual Enrollment Period (AEP)

This runs from October 15 to December 7 each year. During the AEP, you can make changes to your Medicare Advantage or Part D plans.

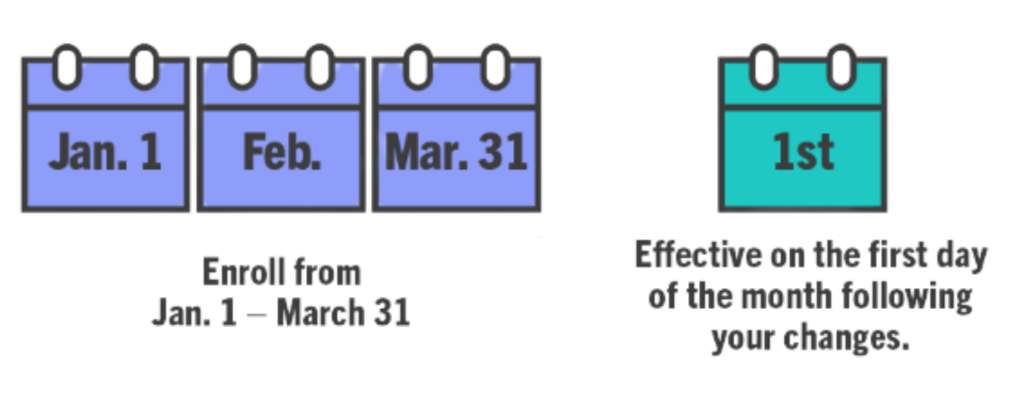

Medicare Advantage Open Enrollment Period (OEP)

This runs from January 1 to March 31 each year. If you're enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or return to Original Medicare during the OEP.

[DOWNLOAD: Printable Timeline of Medicare Enrollment Periods and Deadlines]

(This download will provide a handy timeline that users can print and use to keep track of important Medicare dates and deadlines.)

Call to Action and Next Steps

Congratulations! You've made it to the end of this guide, and you're now well-equipped to avoid costly Medicare penalties and make informed decisions about your healthcare. But the journey doesn't end here.

At Lexah Insurance, we understand the complexities of Medicare. We're dedicated to helping you navigate your options, answer your questions, and find the right coverage for your needs. We are not connected with the government or any government agency. As insurance agents, we offer plans from many different insurance companies to help you find the coverage that works for you. We are licensed in [List of States, or "Nationwide" if that's accurate].

Here's how we can help:

Free Consultation: Schedule a free consultation with one of our licensed insurance professionals. We'll review your situation, answer your questions, and provide personalized recommendations.

Plan Comparison: We can help you compare Medicare Advantage plans and Medigap policies to find the best fit for your needs and budget.

Enrollment Assistance: We can guide you through the enrollment process, making it easy and stress-free.

Contact us today to schedule your free consultation:

Phone: 404-225-6331

Let's chat on Facebook! Click Here for Lexah Insurance Facebook Page

Website: www.LexahInsurance.com

Disclaimer: We are not affiliated with the government or the Medicare program. We are an independent insurance agency offering Medicare plans from a variety of insurance companies.

We hope this guide has been helpful. Remember, you're not alone in this journey. We're here to help you every step of the way.

This is for informational purposes only and is not definitive or absolute. Because laws and rules surrounding Medicare and insurance can change frequently, we recommend you always consult with an insurance professional.